Ofgem announced on 26 August 2022 that the energy price cap would rise to £3,549, up from the £1,971 which came into force in April. The October cap is 178% higher than last winter with the prospect of rising to £5,300 at the deepest part of winter in January 2023, according to some analysts. But when you look at the latest household income and expenditure data, and adjust for inflation over the past year, around three million UK households cannot pay the energy bill this Autumn.

What is the price cap?

While headlines often cite a financial amount, this is not the limit on what a household will pay. The latest cap of £3,549 is what a typical average household would pay, but the cap itself limits what you pay for each unit of gas and electricity used. It also sets a maximum daily standing charge, which is paid regardless of energy use. Think of this as the charge to have access to the National Grid.

Before the October price rise, poorer households have already run out of money due to high inflation

While energy prices will rise dramatically in October, over the past year we have seen a surge in UK inflation across a staple of goods and services. The April 2022 energy cost rises are a key driver behind current inflation, but other costs such as road fuel and food have surged, and these are products that households consume as necessary goods, not luxury. While households can cut car journeys, or shop around for cheaper food alternatives, there is a limit to this.

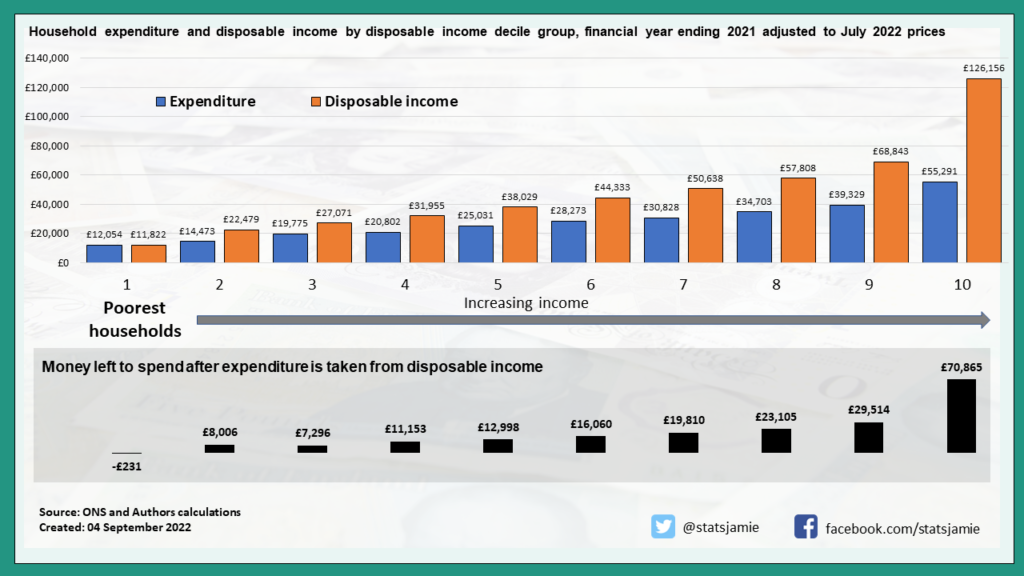

If we take the latest ONS income and expenditure statistics, which are up to the end of March 2021, and adjust for inflation to July 22, if the poorest households (bottom 10% based on income) continued with their expenditure patterns at the latest prices, they would be in debt. So with no Government support, the poorest households cannot pay the increased energy bills this Autumn. The latest income and expenditure data covers a period when most of the country was in lockdown, which affects what households spent, but this mainly affected the richest households who saved money through the pandemic, as travel restrictions limited their ability to spend money.

The richest households have £70k spare money to pay increased energy bills

All summer there have been calls for the Government to do more to help households with rising energy bills and because of their financial situation, emergency support is critical for the poorest households. While no one wants to spend more than necessary for energy, when looking at income and expenditure patterns, the vast majority of households in the UK can afford to pay the higher bills that are coming. At the most extreme end, the most affluent (top 10% of households based on incomes) have around £70,000 left, having paid for the goods and services they consume – over 30 times the estimated increase in their energy bill.

Conclusion

I recently wrote that the strategy of moving towards foreign gas has left the UK exposed to higher energy prices and there is no sign of a fall until energy security is at the forefront of Government policy. A lack of planning by each Government since the 1980s is a key factor in the current cost of living. Nick Clegg when in the coalition Government opposed new nuclear power stations, citing they would not come online until around now. Parliament’s obsession with short-term goals is why energy security is such a mess.

Politicians have different ideas to combat increasing energy prices, with Keir Starmer announcing he would freeze the price cap at April 2022 levels. This is a generous offer but would cost anywhere between £24bn to £37bn in Government support, depending on where the January price cap lands. This is the cost to cover just until the end of March 2023 and there are no signs bills will fall by then so the cost could be an extra £8.5bn per month. But this blanket approach does not consider the ability of a household to pay, and the more affluent households would actually benefit most financially. This is because they have larger homes and consume the most energy, which is not an efficient use of public funds. What is needed is clear support for the three million households who cannot pay with tapering support for those on higher incomes.

We need to remember there is a general election looking in 2024 and the dominant parties are vying for votes as we head towards this. The new Prime Minister will no doubt want to be seen to be generous when taking office to cement a following with the British public. The Government can support as much as it wants but we all own Government debt and so a targeted approach to supporting energy bills is the best use of funds. But this is often more complex to administer, so we may see for simplicity the blanket approach which could fuel more inflation as it means more Government borrowing.

Follow me over on Twitter, Instagram, Facebook, Tik Tok, or Gettr for my daily updates, or read my recent blog looking at how we are seeing higher than expected deaths across the country with many linked to heart issues.