The Bank of England economist Huw Pill has said people in the UK need to accept that they are poorer in a recent US podcast. He said in response to higher prices, workers had responded by asking for wage increases and businesses were charging more. There is some truth to this, but what is key to acknowledge is that the Bank of England is a reason we are poorer through poor policy. They printed money during lockdowns which led to inflation and are making people poorer by increasing housing costs through higher interest rates, when this does little to tackle the root causes of inflation.

Inflation leads to wage demands that if paid can cause more inflation

A wage-price spiral is a self-reinforcing economic cycle in which rising prices lead to demands for higher wages, which in turn lead to higher prices. This can lead to an accelerating rate of inflation, as each round of wage increases is met with a round of price increases. So Mr Pill’s comments about people not demanding wages to match inflation have some legitimacy if we want to try to control inflation.

But a factor that can contribute to a wage-price spiral is a policy that increases the money supply. This can lead to inflation, which can then lead to workers demanding higher wages. During the pandemic, when the economy was contracting, the Bank of England made what many said was a predictable mistake by printing a lot of money, which led to inflation. So a key factor in why we are such an economic mess is the policies and actions of the Bank of England. Mervyn King, the former Governor of the Bank and England, explained in a BBC interview that printing money was a mistake by all central banks that led to inflation.

Great banking rip-off with energy costs and food fueling inflation

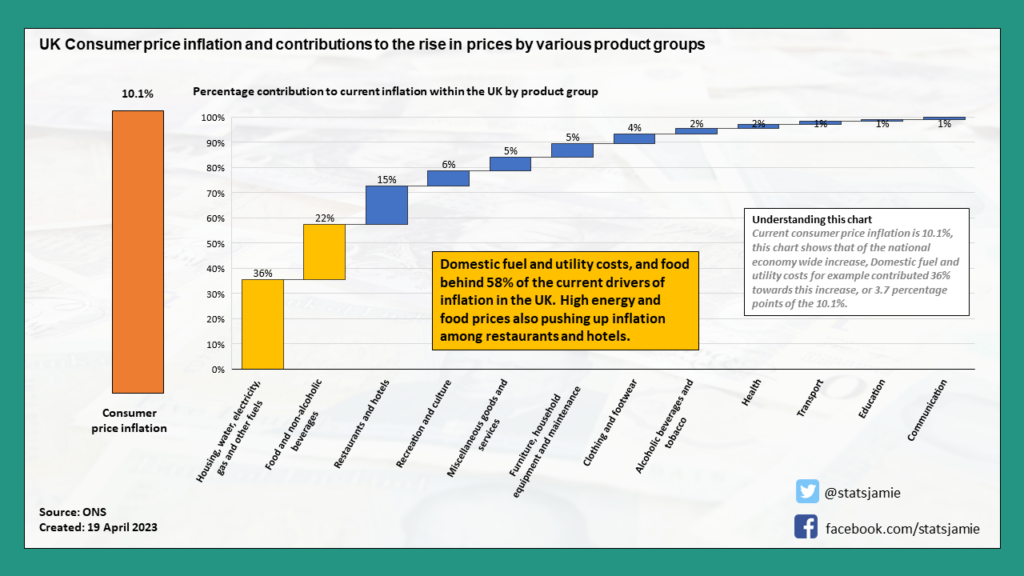

The latest consumer inflation figures for the UK have prices across the economy up 10.1% on a year earlier in March 2023. Energy costs and food prices are behind around 58% of the inflation we are seeing. Inflation for staple foods such as bread and cereals is running at around 19%, but prices are relatively inelastic, meaning that people are still willing to buy them even if the price goes up. This is because these foods are essential for survival and people are less likely to cut back on them even if they are expensive.

Similarly, energy prices are inelastic, meaning that consumers are relatively unresponsive to changes in price. This is because energy is a necessity, and people cannot simply stop using it when prices go up. As a result, when energy prices rise, consumers have to find other ways to make up for the increased cost, such as cutting back on other expenses or taking on more debt.

As I previously wrote, we are experiencing a great banking rip-off as inflation is not demand-driven but driven by supply issues with energy. Increasing interest rates does little to curb the demand for food or energy, it just means consumers have less money as their housing costs increase further, through higher mortgages or rents. The only rationale for increasing interest rates is to maintain the value of the pound for imports. But if all central banks act in unity, there is no need to do this.

Conclusion

It is right to say that if businesses give double-digit pay rises, this has to be paid for somehow, generally through charging more to consumers, which can then lead to more inflation and demands for more wages.

But is Mr Pill out of touch with reality? Many in the media are highlighting his alleged £190,000 a year salary and £1.5m home in London. While that is a question for debate, one this is for sure the actions of his employer, the Bank of England, is a key reason we are poorer through poor policy.

Follow me over on Twitter, Gettr, Instagram, or Facebook for my daily updates.